August 7, 2013

It's not the profit of the job, it's the profit of the whole

BY MARK BRADLEY

Many owners in the landscape industry are in a constant struggle to reduce operating costs in order to sell work at a profitable price in this competitive industry.

In my experiences meeting and teaching contractors across North America, it’s clear that successful companies have embraced some basic tools and knowledge that help their profitability. These same tools are often unknown or misunderstood by the majority. Over the next few articles, I’ll break down some of these profit-growing concepts and use real-world case studies to illustrate how they can be applied in the daily operations of a landscape company.

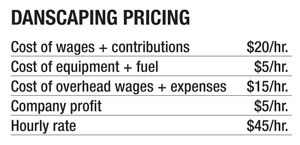

Let’s start with Dan and his company Danscaping. (This example is based on a fictional company and is not intended to represent any companies or owners who may share the same name.) Dan tries to get $45 per man-hour to maintain his clients’ properties. Dan uses an educated pricing system; the chart illustrates how he came up with that rate.

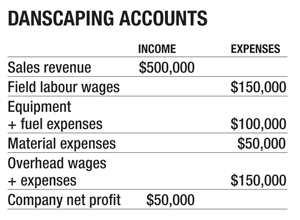

Dan’s company financials are sound, with a healthy 10 per cent profit on his bottom line.

Dan’s company financials are sound, with a healthy 10 per cent profit on his bottom line.The season is already underway when Dan is approached by a good client to do some additional mowing work on a few properties close to Dan’s existing sites. There are no material costs, just labour and equipment. It‘s about four hours of work a week for a three-man crew, or 432 man-hours for the season. Dan has the equipment needed to do the work, and adding a few hours to his crews’ weekly schedules is no problem. The client, however, won’t switch to Danscaping unless Dan will match the client’s current contractor’s rate of $38/man-hour.

Dan knows that at his hourly rate of $45, his built-in profit is $5/hour. He declines the job. At $38/hour, Dan figures he’d be losing money.

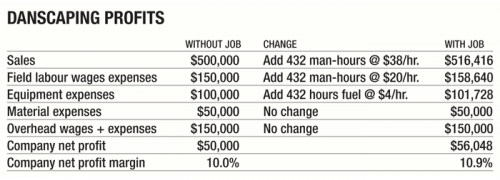

Is he right? If you just looked at this job, yes, it doesn’t seem profitable. But what if Dan pulled back to 25,000 feet and looked beyond job profit and instead focused on his company’s profits? The chart below shows what he would have seen.

Just looking at numbers (there are other variables, too many to discuss here), Dan’s decision was wrong. His company’s net profit would have jumped by more than $6,000. Even more surprisingly, Danscaping’s net profit margin actually increased by almost a full percentage point.

Just looking at numbers (there are other variables, too many to discuss here), Dan’s decision was wrong. His company’s net profit would have jumped by more than $6,000. Even more surprisingly, Danscaping’s net profit margin actually increased by almost a full percentage point.Dan’s confused. He started with a net profit of 10 per cent and declined a job at what looked like a loss but instead would have increased his overall profit margin. Instinct and experience tells us that if you have a 10 cent profit margin and you take a job at minus 5 per cent, your overall profit margin should drop. But the numbers show an entirely different story. What’s happening?

Better-profits concept 1: Maximum profit on every job doesn’t always mean maximum profit for the company.

Consider for a minute what you’re striving for in your business: Are you trying to make maximum profit on every job or maximum profit as a company? Successful companies, in every industry, understand that these objectives are not always one and the same.

Profitability at 25,000 feet, or at company level, is too often missed when we are dealing with the day-to-day details. After all, it’s easy to assume the way to maximize company profit is by maximizing each and every job’s profit. What the “big guys” know, and exploit, is that only about 50 per cent (on average) of a job’s costs are “real”; the rest are simply assumed. What does that mean? Let’s look at Dan’s example again.

When Dan turned down that contract because it didn’t meet his break-even price, what expenses actually changed? He saved 432 hours of extra wages for his field staff, and he saved fuel expenses.

But nothing else actually changed. Dan’s equipment or insurance payments didn’t decrease because he turned down the job. His rent, accountant fees, office salaries, advertising, cell phone bills and computer expenses weren’t affected by his decision.

Am I telling you to ignore overhead costs when bidding work? To be crystal clear, absolutely not.

What I am saying is there are opportunities where you can aggressively price work and improve your bottom line, and being aware of these opportunities will aid your success.

Ever bid against a professional, successful company to have them bid the work with rates that made you shake your head? Maybe they underestimated the costs of the work, maybe they made a mistake, but maybe they got where they are by understanding that, in some cases, a “loss” on a job still improves the company’s overall profit. If the company has untapped capacity to do the work, and their selling price can cover job costs with some left over, net profit improves. And as an added bonus, they’re first in line to get higher margin enhancements and extras.

It’s up to you to use common sense. There’s a time and place for bidding this way. You cannot ignore overhead recovery or you will be out of business in weeks. But, if you feel you can turn down a job and still sell those hours to someone else at your usual rate, you should execute that option.

A few examples where this strategy can be effective include:

- Adding a site or two to the end of a snow or maintenance route when there are available hours

- Adding one or two more construction jobs late in the year

- Filling idle crew time in your schedule

- Utilizing equipment that’s parked at the yard

- Undertaking large contracts or projects that add significant revenue without adding overhead.

Mark Bradley is president of The Beach Gardener and the Landscape Management Network (LMN) in Ontario. LMN provides education, tools and systems built to improve landscape industry businesses.